Stripe Just Became Your Merchant of Record

Stripe just rolled out something new: Managed Payments now in private preview.

This isn’t just a new feature. It’s a big shift in how you can run your SaaS business.

If you’ve been using Lemon Squeezy or Gumroad for tax and compliance reasons, Stripe is now building something similar but directly inside their own ecosystem. It’s Stripe acting as the seller, not you.

Currently in private preview with a planned launch for Summer 2025, this represents Stripe’s strategic move following their acquisition of Lemon Squeezy in 2024.

Let’s go over what this means, who it’s for, and why it might save you hours of work (and stress).

What is Stripe Managed Payments?

Managed Payments is a new way to sell digital products and subscriptions through Stripe, where Stripe becomes your merchant of record.

That means:

- Stripe is the legal seller to your customers.

- Stripe collects and remits sales tax, VAT, and GST where needed.

- Stripe handles fraud prevention and disputes.

- Stripe takes care of customer support (for payment issues).

- You still build the product but Stripe runs the checkout and handles the messy stuff.

It’s Stripe’s answer to tools like Lemon Squeezy and Paddle, built for modern SaaS teams who want to skip the boring legal work and just ship.

What’s a “merchant of record”?

A merchant of record is the legal entity that sells the product to the customer.

Normally, that’s you. That means you’re legally responsible for:

- Registering in every country or state where taxes apply.

- Collecting and remitting those taxes.

- Handling chargebacks and fraud claims.

- Responding to refund requests and disputes.

- Staying compliant with local laws.

With Managed Payments, Stripe takes that on. You act more like a vendor or supplier and Stripe becomes the one officially making the sale.

This saves you time and protects you legally, especially if you’re selling globally.

What kinds of businesses can use it?

Right now, Managed Payments is meant for:

- SaaS products

- Digital software (apps, tools, extensions)

- Digital downloads sold through subscriptions

- Donations and charitable giving (for registered nonprofits)

If you’re running a monthly or yearly subscription and want Stripe to handle the transaction side of things, this is for you.

It’s not for:

- Physical products

- One-off purchases (yet)

- Service businesses (agencies, consultants)

- Donations or fundraising

Why does this matter?

Running a SaaS business might look simple on the outside. But the back office part taxes, legal, chargebacks is a mess, especially when you start selling globally.

Here’s how Stripe’s Managed Payments helps:

1. Tax compliance is handled

Let’s say someone from Germany signs up for your $29/month plan. Germany has strict VAT rules. Normally, you’d need to:

- Register for EU VAT

- Collect the correct VAT amount

- Remit it to the EU via a system like VAT MOSS

Now imagine doing that for customers in Canada, Australia, the UK, and 30+ US states. You’d spend more time doing tax admin than writing code.

With Managed Payments, Stripe handles all of that. They figure out where the customer is, apply the right tax, collect it, and remit it. You don’t lift a finger.

Stripe’s AI-powered Radar system will protect your transactions, leveraging data from $1.4 trillion in annual processing volume. Their Smart Retries feature alone recovered $3.4 billion for businesses in 2023.

2. You don’t have to fight chargebacks

Chargebacks are not just annoying they can be expensive. Even if you win, you usually lose time (and a fixed fee). Plus, if you get too many, you risk penalties or account shutdowns.

With Managed Payments, Stripe deals with chargebacks directly. It’s not your problem anymore.

3. Customer support is offloaded

Let’s say a customer’s credit card was charged twice, or they didn’t get a receipt, or they want a refund. These are all payment-related support requests.

Stripe now handles these on your behalf. You’ll still want to support your actual product, but Stripe will manage the transaction-related stuff.

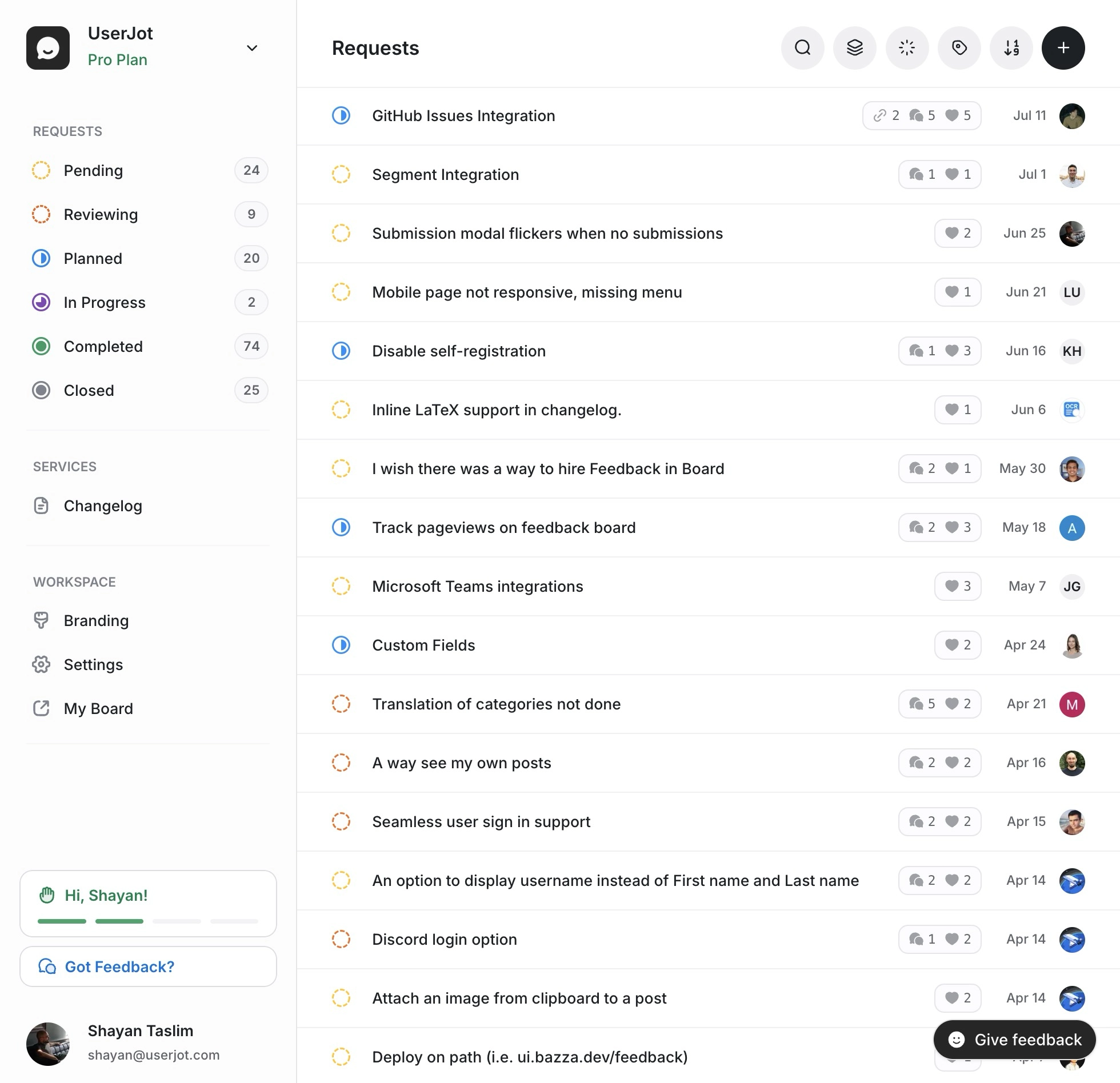

This frees up your team to focus on product-specific feedback. Speaking of which, if you’re looking for a better way to collect and manage customer feedback, UserJot makes it simple to track feature requests, plan your roadmap, and keep customers in the loop with automatic changelog updates.

Stop guessing what to build. Let your users vote.

Try UserJot free4. No more registering in every region

In the past, you might’ve needed to register for sales tax in 10+ countries just to stay compliant. Each one with its own forms, systems, and deadlines.

Now, you don’t. Stripe is the seller, so they deal with all that.

This makes international sales possible for solo founders and small teams without needing an accountant in every country.

What will it cost?

While Stripe hasn’t announced official pricing, industry standards suggest Managed Payments will charge around 5% of your revenue plus processing fees. For context:

- Standard Stripe: 2.9% + 30¢

- Lemon Squeezy (now owned by Stripe): 5% + 50¢

- Paddle: ~5% + processing fees

The premium reflects the value of tax compliance, fraud prevention, and customer support services included.

What does the integration look like?

Right now, Managed Payments only works with:

- Stripe Checkout

- Subscription-based digital products

- Eligible countries (US, Canada, UK, most of EU)

That means you’ll need to use Stripe’s hosted Checkout page for now not Elements or custom-built UIs. It’s limited but very straightforward if you’re just starting or want something simple.

Support for other flows like one-time payments or Stripe Elements might come later as the feature expands.

What if I need something more flexible?

If your use case doesn’t fit yet, Stripe recommends:

- Lemon Squeezy - Stripe acquired Lemon Squeezy in 2024 and recommends it for one-time purchases during the Managed Payments preview period

- Standard Stripe setup using Payments + Tax

- Adding tools like Stripe Connect for platforms and marketplaces

If you want to compare the costs of different processors, we did a breakdown you can check out here: 👉 Payment Processor Fees Compared: Stripe, Polar, Lemon Squeezy, Gumroad

Is it worth signing up?

If you’re a solo founder or small team, and you’re spending too much time:

- Dealing with tax rules

- Responding to Stripe-related support

- Managing chargebacks

- Stressing over legal compliance

Then yes Managed Payments is worth checking out.

It’s not for everyone just yet. But if your business fits their criteria and you’re eligible, this can offload a big chunk of boring work and let you focus on building your product.

You can sign up for the waitlist here. The platform launches Summer 2025, with priority access given to businesses already using multiple Stripe products.